By far we all know that by using Sage CRM, we can manage and maintain the Sales process in very efficient manner. Different entities such as Lead, Opportunity, Quote, Orders etc. falling under the Sales process makes it very appropriate from the Business point of view. Since every sales process ends up at the costing efforts, it is very much important to apply/charge the Customer as per the taxes applicable.

New Stuff: Monitoring Sales Team performance with the help of Dashboard

Since Sage CRM’s standard quotation entity does not have any provision to capture or apply the taxes, so recently we implemented this functionality for one of our clients. Here the requirement was to calculate CST amount on Quote level which is applicable when you charge a client who is located in different state as that of yours.

To implement this feature on Quote we followed below given steps.

1. We created CST as Numeric field on Quote entity

2. We created new Translation to configure percentage of CST.

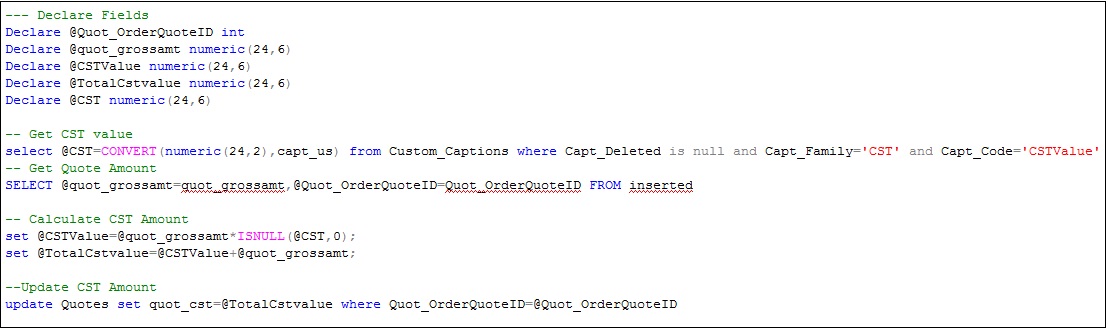

3. Created new Trigger to Calculate CST percentage amount based on Total amount of Quote.

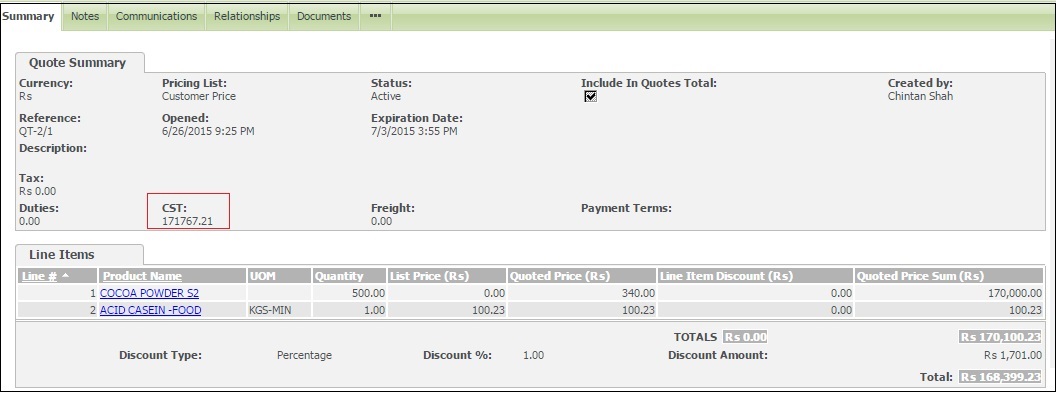

Please refer the below screenshot for your reference

Refer below given SQL Script

On making the necessary configurations, whenever a quote is generated in system. CST amount will be calculated as per the formulae applied on the Total quote value generated by adding the Line items.

Also Read:

1) Effective use of CPQ (Configure Price Quote) in Sage CRM

2) Quote Summary Screen Enhancements in Sage CRM 7.3

3) Create Quotes in Sage ERP X3 from Sage CRM

4) Clone Quotes and Orders in Sage CRM

5) Default quote expiration/Delivery date setting in Sage CRM

Sage CRM – Tips, Tricks and Components

Explore the possibilities with Sage CRM insights through our comprehensive blogs. As a leading Sage partner, Greytrix helps businesses maximize their Sage CRM potential with its rich expertise and immense knowledge. Here, you will find blogs that feature expert advice, tips & tricks, best practices, and comprehensive guides on customizing and configuring Sage CRM for your business. Stay informed with our regular updates and expert insights!