How will multi-currency support benefit organizations?

Today, businesses are not bound by borders. With globalization and the growing transparency in business operations, organizations are exploring opportunities in foreign markets. To function exceptionally in the global marketplace, businesses need multi-currency support to carry out seamless transactions. Given the complexity in managing multi-currency for different scenarios, Sage X3 is a holistic enterprise management solution that offers multicurrency functionality enabling businesses to handle different currencies within your accounting system. Sage X3 Multi-Currency support calculates exchange rates using the Vendor / Customer’s currency or your native currency and provides the costs you gain or lose due to the currency fluctuations to General Ledger. Sage X3 ERP application completely supports transactions across multiple currencies and includes the following capabilities:

- Transactions of different currencies from your accounting currency

- Exchange differences are managed automatically by the reconciliation system

- Maintain bank accounts with the multiple currencies

Check now: Sage X3 – An unparalleled business management solution

What are the important concepts of multi-currency?

The multi-currency feature in Sage X3 comprises of two main concepts –

Conversion: Conversion refers to a foreign currency transaction that is immediately converted in the functional currency (i.e. the ledger currency).

Translation: Translation refers to the restatement of an entire ledger or balances for a company from functional currency to foreign currency.

How to configure Sage X3 Multi-Currency in your organization?

In order to configure Sage X3 Multi-Currency in your organization, please follow the step by step procedure as stated below:

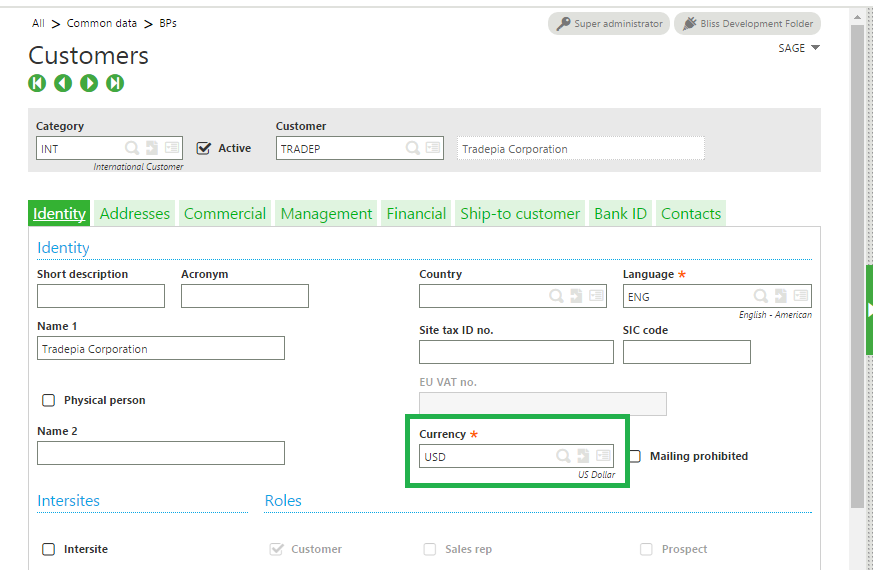

- Customer Master Setup

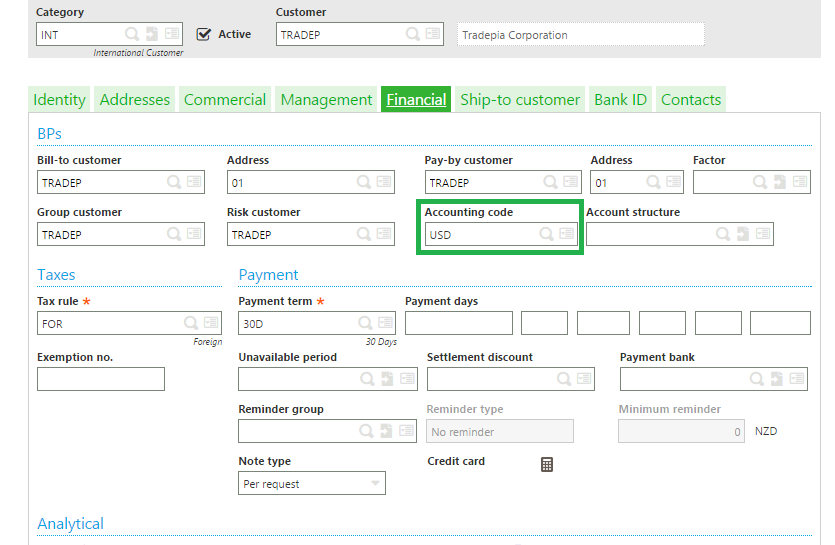

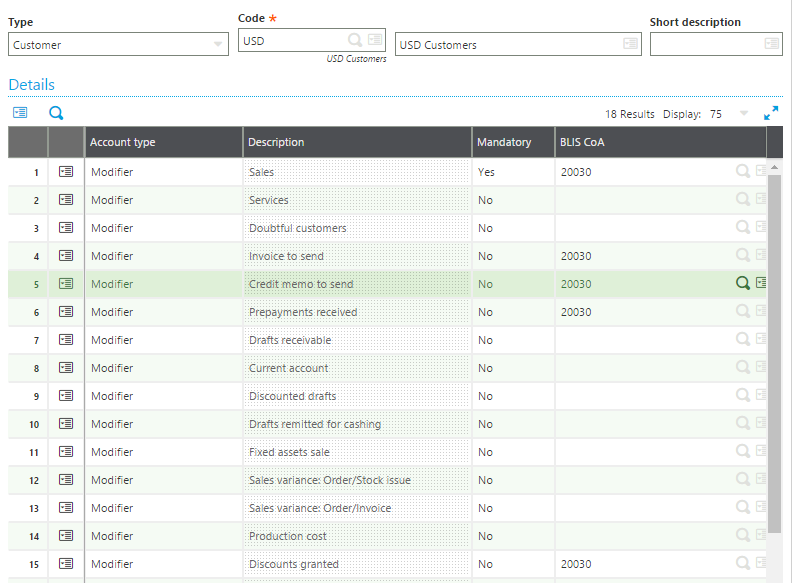

- Accountings Tagging in Customer Master

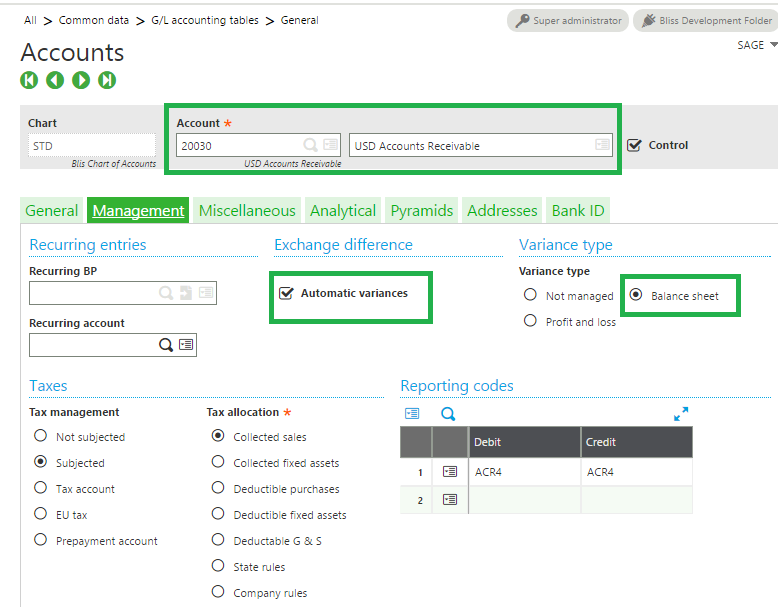

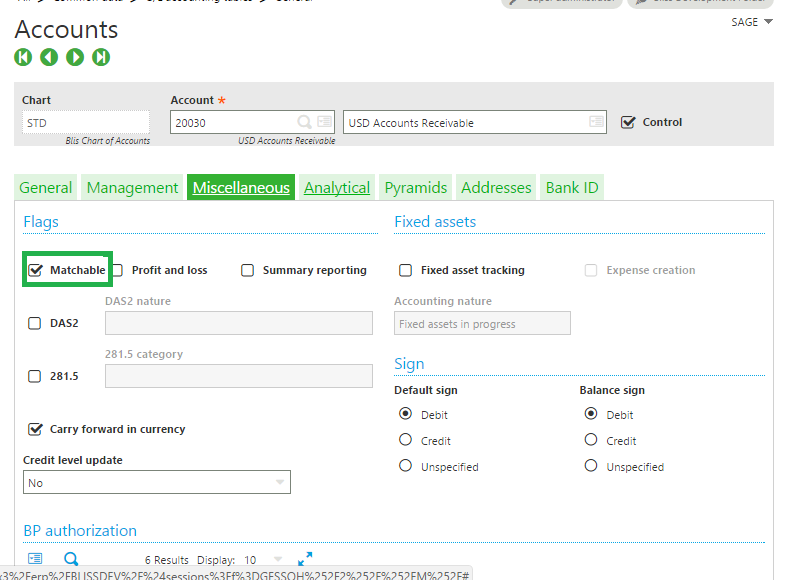

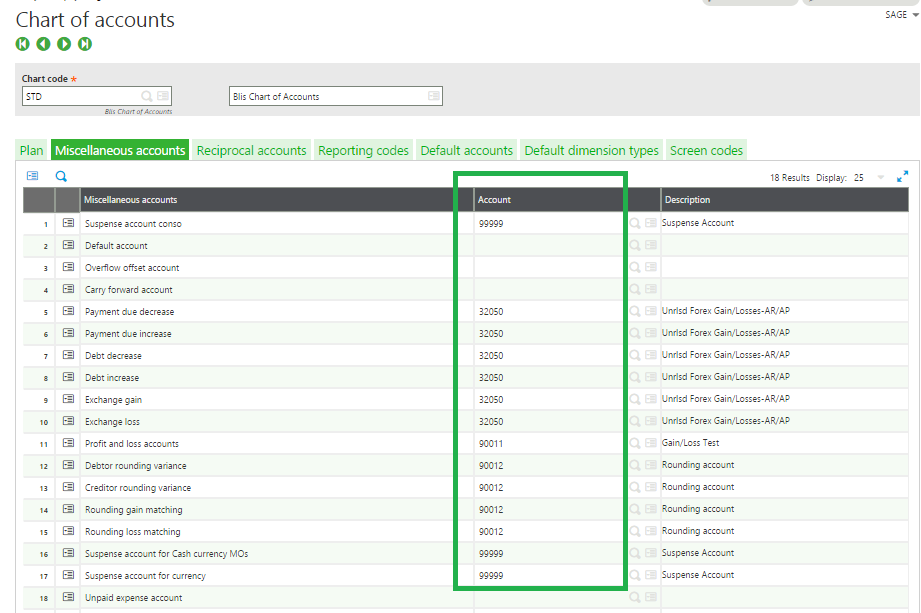

- Accounts Master setup

Below is the Accounting Effect for the multi-currencies for Export.

Invoice in Foreign Currency (), Payment in Local Currency () Profit.

| Invoice | Customer/Account Receivable A/c | Debit | |

| To Sales A/c | Credit | ||

| COGS A/c | Debit | ||

| To Goods Sold Not Invoiced A/c | Credit | ||

| Payment | Bank / Cash A/c | Debit | |

| To Suspense Account for Currency A/c | Credit | ||

| Suspense Account for Currency A/c | Debit | ||

| Customer/Account Receivable A/c | Credit | ||

| Unrealised Income | Customer/Account Receivable A/c | Debit | |

| To Unrlsd Forex Gain/Losses AR/AP A/c | Credit |

Invoice in Foreign Currency (), Payment in Local Currency () Loss.

| Invoice | Customer/Account Receivable A/c | Debit | |

| To Sales A/c | Credit | ||

| COGS A/c | Debit | ||

| To Goods Sold Not Invoiced A/c | Credit | ||

| Payment | Bank / Cash A/c | Debit | |

| To Suspense Account for Currency A/c | Credit | ||

| Suspense Account for Currency A/c | Debit | ||

| Customer/Account Receivable A/c | Credit | ||

| Unrealised Income | To Unrlsd Forex Gain/Losses AR/AP A/c | Debit | |

| To Customer/Account Receivable A/c | Credit |

Invoice in Foreign Currency (), Payment in Foreign Currency () Profit.

| Invoice | Customer/Account Receivable A/c | Debit | |

| To Sales A/c | Credit | ||

| COGS A/c | Debit | ||

| To Goods Sold Not Invoiced A/c | Credit | ||

| Payment | Bank / Cash A/c | Debit | |

| To Customer/Account Receivable A/c | Credit | ||

| Unrealised Income | Customer/Account Receivable A/c | Debit | |

| To Unrlsd Forex Gain/Losses AR/AP A/c | Credit |

Scenario IV Invoice in Foreign Currency (), Payment in Foreign Currency () Loss.

| Invoice | Customer/Account Receivable A/c | Debit | |

| To Sales A/c | Credit | ||

| COGS A/c | Debit | ||

| To Goods Sold Not Invoiced A/c | Credit | ||

| Payment | Bank / Cash A/c | Debit | |

| To Customer/Account Receivable A/c | Credit | ||

| Matching | To Unrlsd Forex Gain/LossesAR/AP A/c | Debit | |

| To Customer/Account Receivable A/c | Credit |

Invoice in Foreign Currency (), Payment in Local Currency () Loss.

| Invoice | Customer/Account Receivable A/c | Debit | |

| To Sales A/c | Credit | ||

| COGS A/c | Debit | ||

| To Goods Sold Not Invoiced A/c | Credit | ||

| Payment | Bank / Cash A/c | Debit | |

| To Suspense Account for Currency A/c | Credit | ||

| Suspense Account for Currency A/c | Debit | ||

| Customer/Account Receivable A/c | Credit | ||

| Unrealised Income | To Unrlsd Forex Gain/Losses AR/AP A/c | Debit | |

| To Customer/Account Receivable A/c | Credit |

Invoice in Foreign Currency (), Payment in Foreign Currency () Profit.

| Invoice | Customer/Account Receivable A/c | Debit | |

| To Sales A/c | Credit | ||

| COGS A/c | Debit | ||

| To Goods Sold Not Invoiced A/c | Credit | ||

| Payment | Bank / Cash A/c | Debit | |

| To Customer/Account Receivable A/c | Credit | ||

| Unrealised Income | Customer/Account Receivable A/c | Debit | |

| To Unrlsd Forex Gain/Losses AR/AP A/c | Credit |

Scenario IV Invoice in Foreign Currency (), Payment in Foreign Currency () Loss.

| Invoice | Customer/Account Receivable A/c | Debit | |

| To Sales A/c | Credit | ||

| COGS A/c | Debit | ||

| To Goods Sold Not Invoiced A/c | Credit | ||

| Payment | Bank / Cash A/c | Debit | |

| To Customer/Account Receivable A/c | Credit | ||

| Matching | To Unrlsd Forex Gain/LossesAR/AP A/c | Debit | |

| To Customer/Account Receivable A/c | Credit |