Sage X3, is a complete business management solution designed to drive productivity and give you total control and visibility of your enterprise. With customizable configuration, the flexible solution equips you with everything you need to drive business success and easy to understand all the modules to the end user.

Recently we had a requirement from one of our client, if a sales invoice is created with some amount then user can create credit note against that invoice with same amount. User will not be allowed to exceed the invoice amount while creating Credit Note entry.

We will see the functionality in detail:

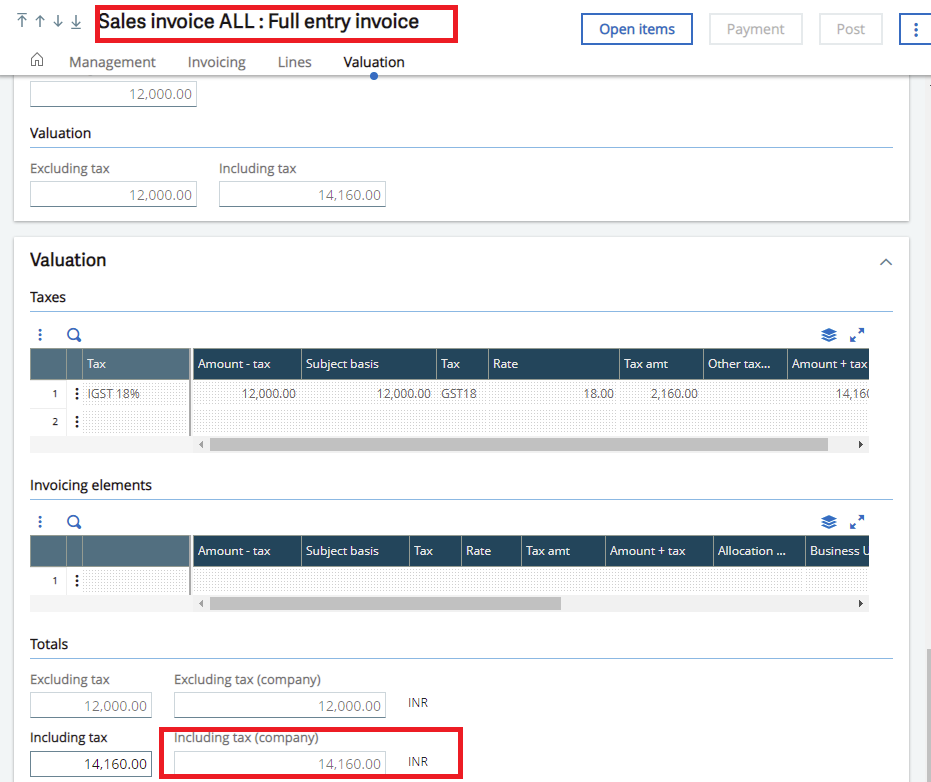

Navigate to: Sales -> Sales Invoice -> All full entry

In the sales module, the user will create a sales invoice entry. For example – he has created an invoice of 14,160(Including Tax Amount).

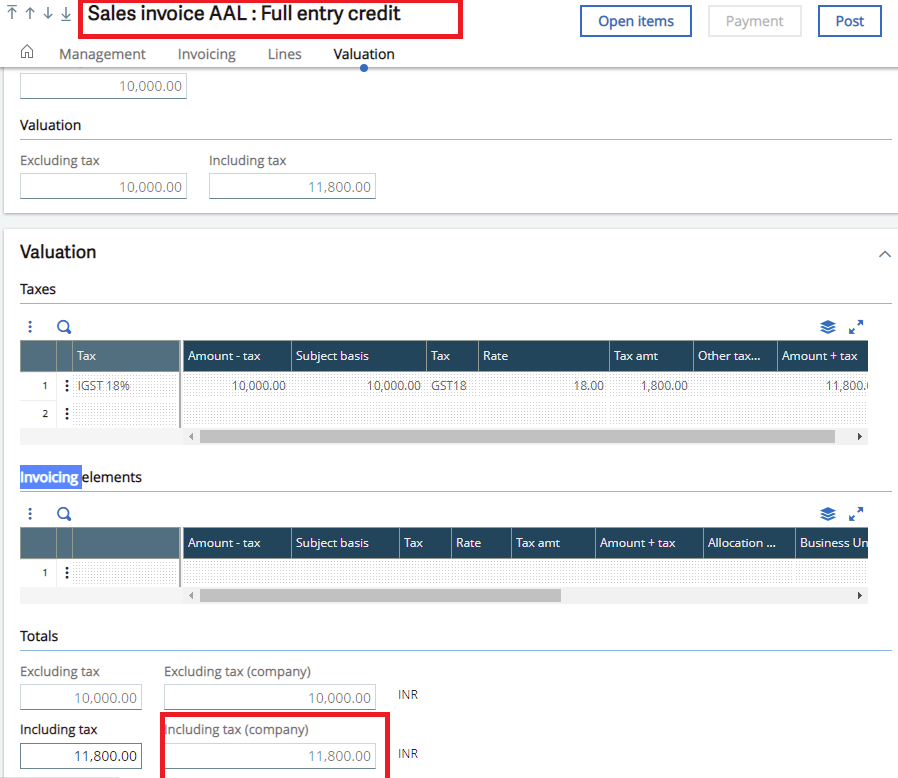

Then the user is trying to create Sales credit Note against the same invoice.

Navigate to: Sales -> Sales Invoice -> AAL full entry credit

center>

Then the user will select the sales invoice number from the left panel of the screen for which he wants to create the credit note.. The sales invoice which the user created previously was of 14,160. And as you can see in the above screen shot, the credit note value is less than the invoice amount. So the system will allow user to create this credit note.

center>

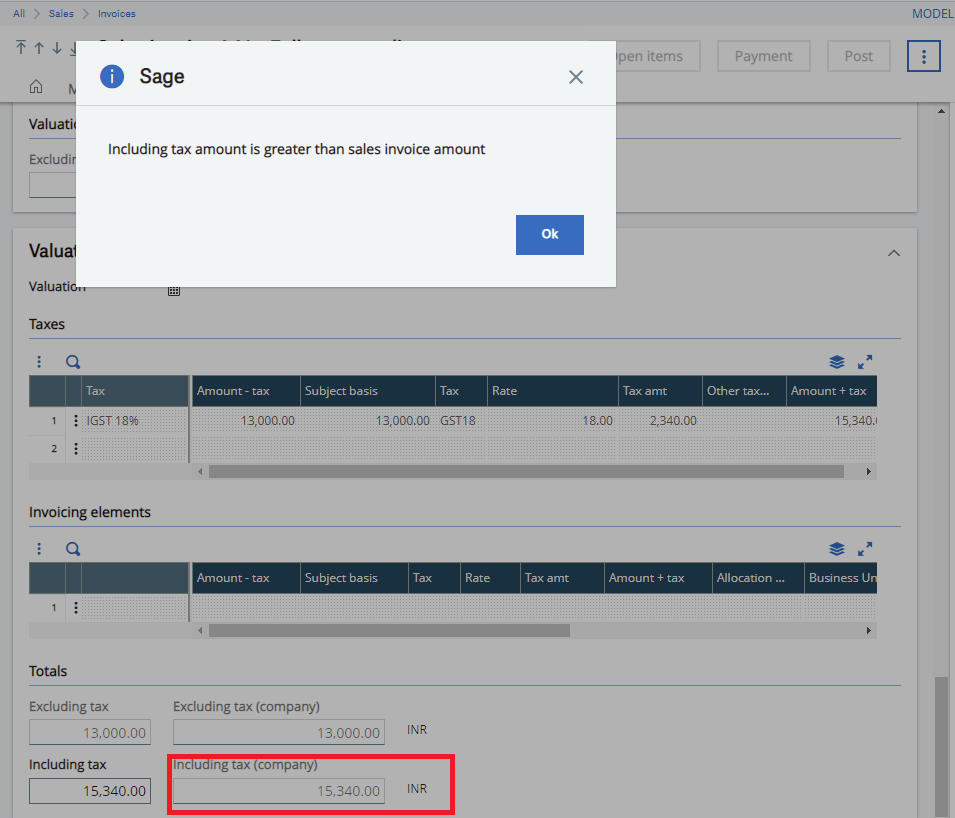

Now, if the user tries to modify the values in the same credit note with the value which exceeds the sales invoice amount, then the system will not allow the user to save that credit note against that sales invoice and the Pop up message will be displayed – “Including tax amount is greater than sales invoice amount” as shown in the above screen shot. Similarly, the functionality will work on creation of the Credit Note. Pop-up will be generated while creating credit note transaction against invoice if the amount exceeds the invoice amount and transaction will be restricted.

So, in this way, we have applied the restriction on Credit Note creation or modification on the basis of Sales Invoice Amount.