Withholding Tax is also called as retention tax or TDS. Its requirement of Government to deduct or withhold a particular percentage from paying to the vendor and pay such amount to the Government on behalf of the company. It’s a kind of Indirect Tax. Withholding Tax (WHT) is tax withheld by a company when making a payment to a vendor, in which the full amount owed to that vendor is reduced by the tax withheld.

Withholding Tax can be deducted at two points of time. It can be either at the time of invoice or at the time of payment. So for this Withholding tax types are to be created one for invoice and second for payment.

Check– Features and Benefits of Sage X3 for East African enterprises

Define Withholding Tax Type for Payment Posting

Withholding tax type is assigned for the payment purpose and the same will not get triggered at the time of Invoice Posting. The withholding information is to be provided while posting for such document for Withholding Tax Payment

To successfully bring this functionality in Sage X3 follow steps.

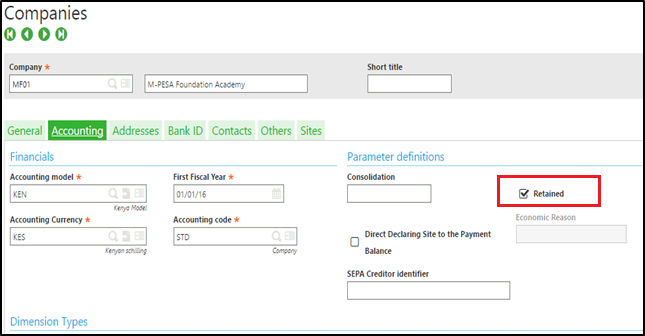

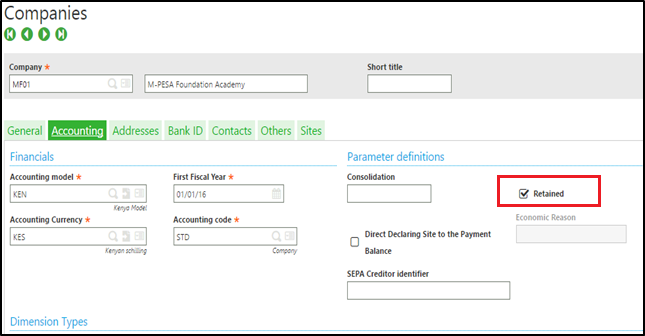

Navigate to All>>Parameters>>Organizational Structure>>Companies>>Accounting Tab

Retained checkbox should be checked.

Define Withholding Tax Type

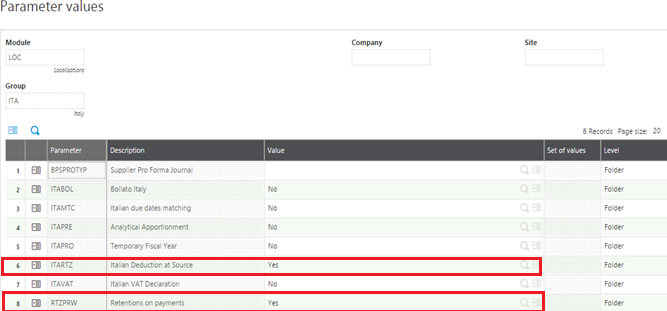

Below parameters should be set yes in Parameter value

Navigate to All>>Parameters>>General parameters>>LOC

- ITARTZ : Italian Deduction at Source

- RTZPRW : Retentions on payments

Parameter value

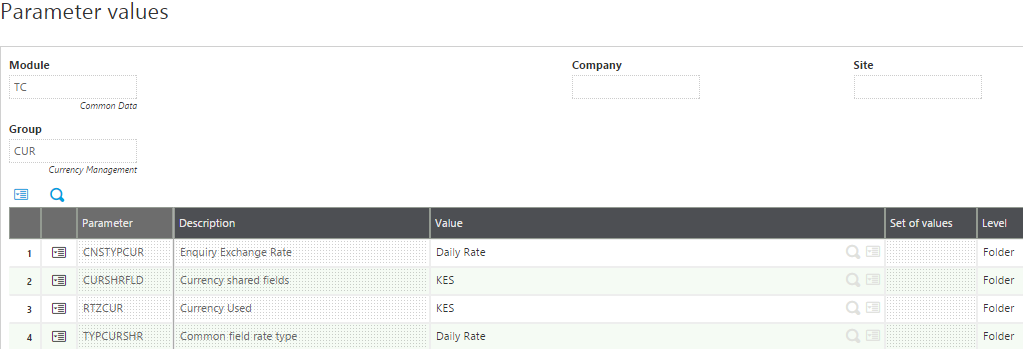

Define currency into which the amounts of retention needs to be shown.

Navigate to All>>Parameters>>General parameters>>LOC

RTZCUR: Currency Used

General Parameters

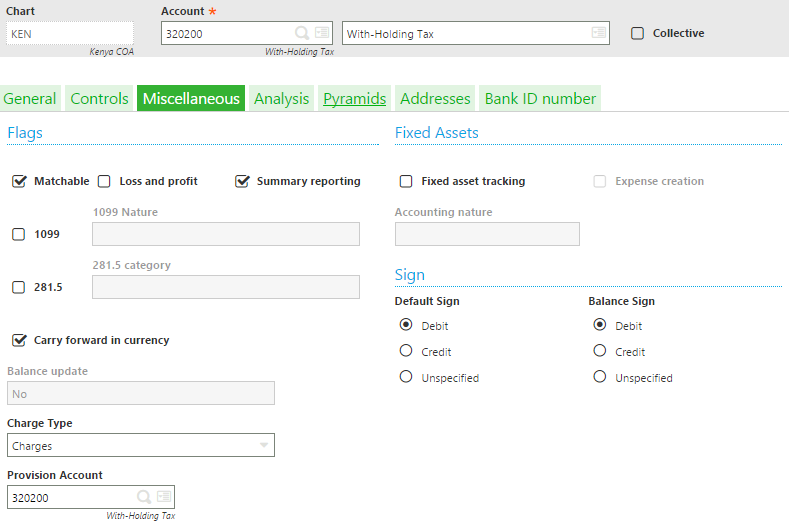

New With-Holding Tax account needs to be created.

Define Withholding Tax Type

Select the charge type as Charges on Miscellaneous Tab

Charge Type

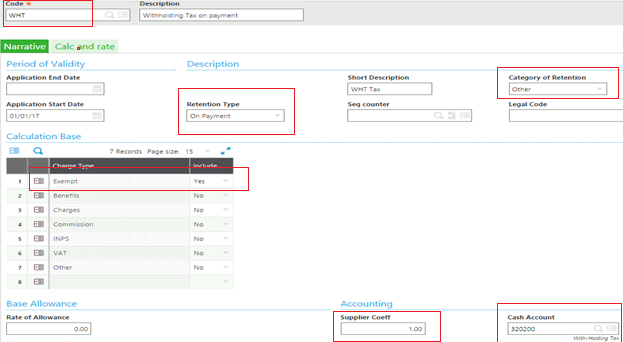

The configuration of Withholding tax for Payment

Navigate to Common Data>>Common tables>>Retention Management

Below settings should be defined on narrative Tab of Retention Management screen.

- Creation of a new retention code – WHT

- Category of retention – other

- Retention type – On Payment

- Charge type – Calculation base put (Exempt) =Yes

- Supplier coefficient – 1,

Cash account – “320200”

Configuration of Withholding tax

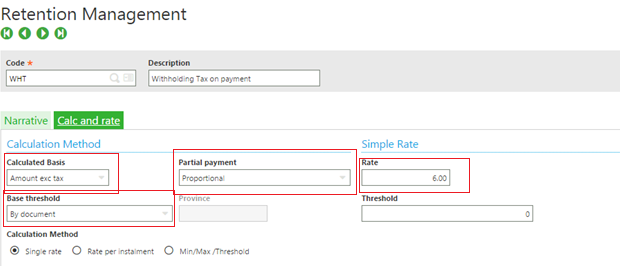

Below settings should be defined on Calc and rate Tab of Retention Management

- Calculated bases- Amount exc tax ,

- Partial payment- Proportional,

- Base threshold – by document,

- Single rate- 6%

Retention Management

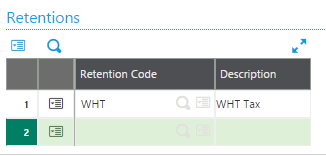

After creation of retention code same needs to be tagged in supplier master as shown below before creating a payment or an invoice:

Navigate to Common data>>Supplier>> Financials Tab

Retentions