Most cash flow forecasts are structured correctly and carefully reviewed, yet still fall short in practice. On the surface, the job is done when the numbers line up or the assumptions are documented. Yet in many fintech organizations, finance teams adjust plans due to unexpected cash timing and availability challenges during execution.

The challenge here is that forecasting seems reliable, but it cannot adapt as quickly as money actually moves. In high-volume situations, small shifts in payment behavior or settlement timing can influence decisions. This challenge becomes sharper in fintech environments.

Why is cash flow forecasting harder in fintech?

Cash flow forecasting is complicated in the fintech industry because money moves through many unpredictable paths. It flows across payment gateways, lending platforms, banks, and other internal systems, each with its own processing logic and settlement timelines. Even with steady revenue, usable cash timing is affected by settlement, compliance, and partner processes.

Organizations in this industry operate across multiple entities, geographies, and currencies. Past data forecasts often lag, explaining past outcomes but rarely reflecting current cash behavior in digital finance.

Fintech Scenarios Where Forecasts Fall Behind

The impact of disconnected cash flow forecasting is most evident in day-to-day fintech operations. Not as errors but as timing mismatches during execution,

| Fintech model | What forecasts assume | What happens in practice |

| Digital lending | Repayments follow scheduled timelines. | Customer payments sometimes slip or arrive in partial amounts, causing sudden liquidity pressure. |

| Payment-led platforms | Settlement timing remains consistent as volumes grow. | Volumes increase, but settlement cycles lengthen due to partner and compliance processes. |

| AR-heavy fintech operations | Aging clears within expected periods. | Delays roll forward, partial settlements recur, and timing varies with transaction volume. |

Forecasts are usually accurate, but they lose relevance when payment and settlement behaviour change faster than models can adjust.

For fintech organizations operating at scale, this is also where ERP systems like Sage X3 play a critical role. This finance ERP helps teams align forecasting logic with real cash movements rather than past data.

How Sage X3 Supports Cash Flow Forecasting

Finance teams use ERP platforms like Sage X3 to link receivables, payables, and cash across entities and currencies, creating a reliable foundation for forecasting.

In fintech environments, the challenge is rarely forecasting cash amounts; it is understanding when cash becomes available for use. Sage X3 addresses this by maintaining real-time cash positions derived directly from open receivables, payables, and bank balances across entities.

At an operational level, this is enabled through:

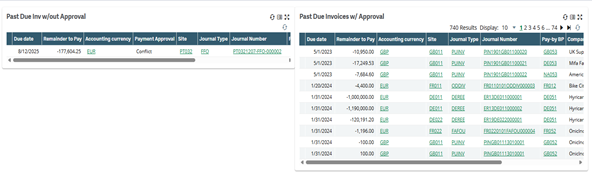

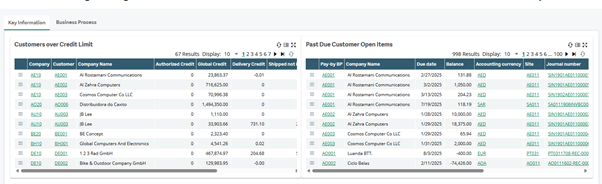

- Live AR and AP aging, where receivables and payables are continuously updated as settlements, partial payments, or delays occur.

- Centralized cash management, which consolidates bank balances and cash positions across entities and currencies.

- Integrated GL, AR, AP, and Cash modules, ensuring movements are reflected once, at source, without manual reconciliation.

In fintech environments, Sage X3 is not designed to operate as a real-time transactional engine alongside payment or lending platforms. Instead, it serves as the financial control and reporting layer, consolidating settlement-aware data from receivables, payables, and cash into dashboards and managerial views. This enables finance teams to accurately assess liquidity and timing risk to support informed decision-making.

With this setup, since forecasts reference real-time settlement and inter-entity cash positions, finance teams can observe liquidity changes as they happen during execution, not afterward.

This visibility allows adjustments to funding, payouts, or credit exposure while transactions are still in motion.

Scenario-based planning within Sage X3 then allows finance leaders to test the impact of delayed collections, stretched settlements, or volume spikes before those conditions affect liquidity or growth decisions.

As a result, forecasting shifts from a static planning exercise to a control process that remains relevant during execution, supporting more confident decisions as fintech operations scale.

Where Sage X3 and Greytrix fit in fintech forecasting

When Sage X3 is implemented with fintech execution realities in mind, its impact extends beyond forecasting accuracy into leadership-level decision confidence.

Cash position views reflect real settlement status rather than planned schedules, improving liquidity planning during execution. On that basis, scenario-based planning helps leaders evaluate the impact of delayed collections, stretched settlements, or volume spikes before decisions are locked in.

At a leadership level, this translates into practical outcomes:

- Forecasts that stay relevant during both planning and execution

- Cash buffers aligned with actual inflows and outflows

- Clearer visibility into timing risks across lending, payments, and receivables

- Growth and credit decisions grounded in realistic cash flow expectations

Sage X3 supports this by anchoring forecasts to settlement status and usable liquidity, rather than on planned assumptions.

By centralizing general ledger, receivables, payables, and cash management, Sage X3 gives finance teams a single, consistent view of financial data. This matters for forecasting as cash positions, aging, and intercompany movements are shown together, not reconciled later. For fintech firms operating across currencies and entities, this view improves cash planning and compliance.

Automation is crucial for handling routine tasks such as invoice posting, reconciliations, and payment tracking within the system, minimizing manual effort and delays. This ensures forecasts rely on current financial activity rather than outdated data. Sage X3’s open architecture enables integration with payment platforms and fintech apps, so settlement data feeds into forecasting logic rather than being routed through disconnected systems.

The Greytrix Approach to Make Cash Flow Forecasting Work At Scale

Greytrix partners with fintech organizations as a systems and finance collaborator. Using Sage X3 effectively in fintech environments requires more than system knowledge. It requires a clear understanding of how financial operations behave as transaction volumes grow, entities expand, and regulatory requirements tighten. This is where implementation decisions directly influence forecasting quality.

With decades of ERP and financial experience, it tailors Sage X3 to fit finance teams’ workflows. It connects Sage X3 with payment platforms, lending systems, and financial tools via secure APIs to improve forecasting accuracy. This ensures cash flow data is automatically entered into the ERP, reducing manual reconciliation delays and aligning forecasts with actual cash movement.

As the business expands, Sage X3 provides financial control, and Greytrix customizes it to support confident decision-making as fintech operations expand.

In fintech, forecasting doesn’t fall behind because the numbers are wrong. It falls behind when systems can’t keep up with how money actually moves.

When forecasts are built around real cash behavior, finance regains its role as a guide for decisions, not just a recorder of outcomes.

About Us

Greytrix – a globally recognized and one of the oldest Sage Development Partners is a one-stop solution provider for Sage ERP and Sage CRM organizational needs. Being acknowledged and rewarded for multi-man years of experience and expertise, we bring complete end-to-end assistance for your technical consultations, product customizations, data migration, system integrations, third-party add-on development, and implementation competence.

Greytrix has some unique integration solutions developed for Sage CRM with Sage ERPs namely Sage X3, Sage Intacct, Sage 100, Sage 500, and Sage 300. We also offer best-in-class Sage ERP and Sage CRM customization and development services to Business Partners, End Users, and Sage PSG worldwide. Greytrix helps in the migration of Sage CRM from Salesforce | ACT! | SalesLogix | Goldmine | Sugar CRM | Maximizer. Our Sage CRM Product Suite includes addons like Greytrix Business Manager, Sage CRM Project Manager, Sage CRM Resource Planner, Sage CRM Contract Manager, Sage CRM Event Manager, Sage CRM Budget Planner, Gmail Integration, Sage CRM Mobile Service Signature, Sage CRM CTI Framework.

Greytrix is a recognized Sage Champion Partner for GUMU™ Sage X3 – Sage CRM integration listed on Sage Marketplace and Sage CRM – Sage Intacct integration listed on Sage Intacct Marketplace. The GUMU™ Cloud framework by Greytrix forms the backbone of cloud integrations that are managed in real-time for the processing and execution of application programs at the click of a button.

For more information on our integration solutions, please contact us at sage@greytrix.com. We will be glad to assist you.