The deposit register of SAGE Accpac allow you to view all deposit to a bank account, or for a range of bank accounts, for a specified period.

Feature of the report are as follow:

• You can view bank deposit status from any specific source application (like AP, AR) or range of applications.

• You can specify the additional selection criteria, such as deposit types.

• You can sort the report by transaction number, transaction date, or customer name.

• You can print a summary report or a detailed report, or we can print details and a summary.

New Stuff: Reminder in Sage 300 ERP

To print this report follow the steps mentioned below:

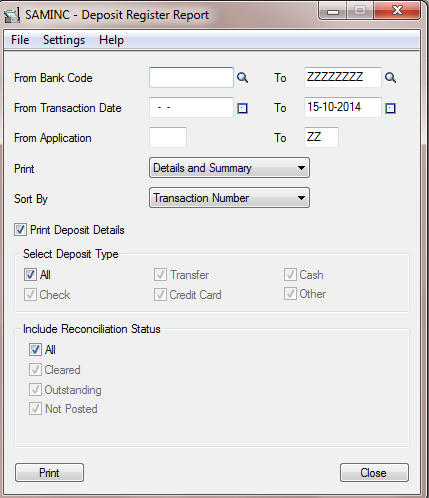

1. Open Bank Services > Bank Transaction Reports > Deposit Register.

2. Use the From Bank Code / To fields to identify the range of banks to include in the deposit register.

3. Use the From Transaction Date / To fields to specify the range of transaction dates for the deposits to include on the register. (The session date is the default To date field.)

4. Use the From Application / To fields to specify a range of source ledgers (for example, AR for Accounts Receivable, BK for Bank Services) for the deposits.

5. From the Print list, select the level of detail for the report.

6. In the Sort By field, specify whether to sort deposits by transaction number, transaction date, or description/customer name.

7. If you want to print the individual receipts that make up the deposits, select the Print Deposit Details option. (Printing details limits the reconciliation statuses you can include.)

8. Select the type of deposits to include on the register.

9. Specify the reconciliation statuses of the transactions you want to include on the register.

10. Click Print.

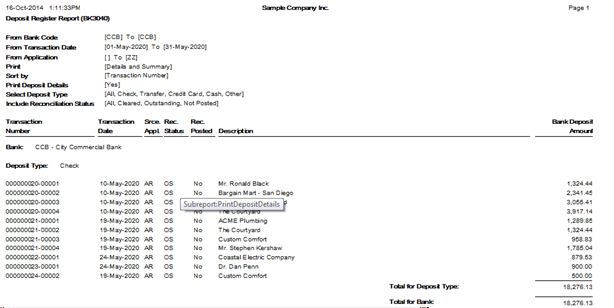

Below is the screen Shot of the report, it is printed as Detail and Summary & sorted by Transaction Number including the all deposit type and all reconciliation status.

Information printed on this report

If you are printing deposit details, the report includes the following information:

• Transaction Number

• Deposit/Reversal Date

• Source Application

• Reconciliation Status

• Reconciliation Posted

• Customer Name

• Bank Deposit Amount

The report lists transactions by deposit type for each bank code, and it provides totals for each deposit type

Hence with the help of this report you can view the all deposit activity for a bank account.

Also Read:

1. AR Deposit Slip & Daily Collection Sheet

2. Bank Reconciliation Reports in Sage 300 ERP

3. Clearing Deposit one by one in Bank Reconciliation

4. Transaction History Inquiry

5. Check/Payment Register Report

Sage 300 ERP – Tips, Tricks and Components

Explore the world of Sage 300 with our insightful blogs, expert tips, and the latest updates. We’ll empower you to leverage Sage 300 to its fullest potential. As your one-stop partner, Greytrix delivers exceptional solutions and integrations for Sage 300. Our blogs extend our support to businesses, covering the latest insights and trends. Dive in and transform your Sage 300 experience with us!