In our previous blog post, we discussed about the setup option in PJC module. In this post, we will discuss in detail about each Accounting Method available in PJC Module Stage for which revenue will be recognized.

The New Stuff : Allow edit of System generated batches

In PJC Module, there are a total of seven types of accounting methods available. User can select any Accounting Method by selecting “Default accounting method”. It will be default for all new contracts or projects.

The default accounting methods are as follows:

• Completed Project,

• Total Cost Percentage Complete,

• Labor Hours Percentage Complete,

• Billings and Costs,

• Project Percentage Complete,

• Category Percentage Complete and

• Accrual-Basis.

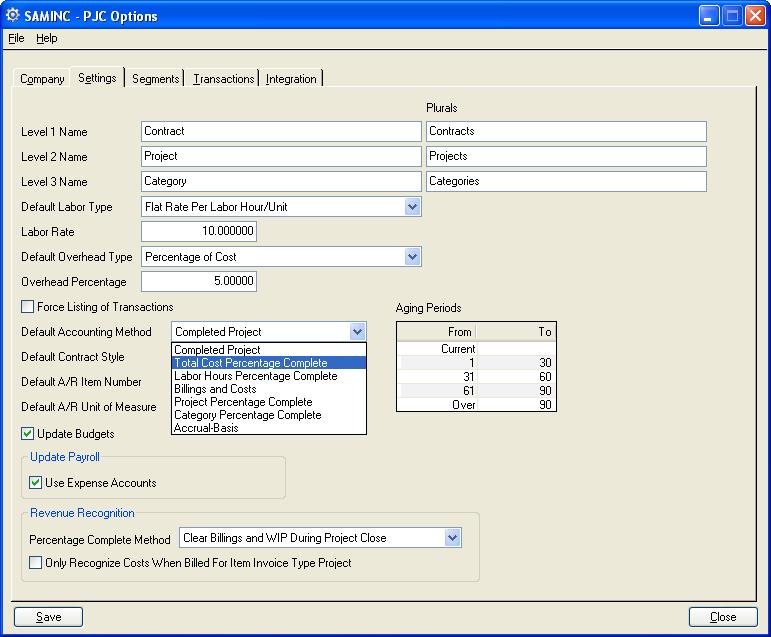

To select the default accounting methods for all new contracts or projects please follow the path:

Project and Job Costing–>PJC Setup–> Options–>Select the Default Accounting Method.

Please refer below screenshot for reference.

Each accounting method will recognize revenue differently. Let’s see the accounting methods in brief:

• Complete Project :

If user selects this method, then system will recognize the revenue upon completion of the project.

This method is basically used when costs are difficult to estimate or there are many ongoing small jobs and project is of short duration.

• Total Cost Percentage Complete :

On selecting this method, PJC will use the percentage between total cost incurred and total estimated cost of the project to calculate the revenue automatically.

• Labor Hours Percentage Complete :

If User selects this method, then revenue will be calculated on the ratio of Total labor hours invested and estimated total labor hours.

• Billing and Cost :

If selected, then revenue will be calculated throughout the project on the basis of amount Billed and actual cost incurred on the project to date.

This method is favored by those who want to recognize the largest possible proportion of project revenues in the early stages of project, since most of the direct material costs are incurred at the beginning of project.

• Project Percentage Complete :

If selected, then the revenue will be calculated throughout the project on the ratio of actual cost incurred to estimated cost of the project.

This method is used when it is reasonably possible to estimate the stages of project completion on an ongoing basis, or at least to estimate the remaining costs to complete the project.

• Category percentage complete :

On selection of this method, revenue will be calculated automatically on the basis of ratio of actual cost invested for project category to estimated cost for the project category.

• Accrual-Basis :

With this accounting method, the program posts transactions directly to the revenue and cost of sales accounts. This method, also referred to as the Modified Cash Basis, combines elements of both accrual and cash basis accounting.

This method also records income when it is earned but deducts expenses when they are paid out. The recording of income is then on accrual basis, while the recording of expenses is on cash basis.

Also Read:

1. Sage 300 ERP Project and Job Costing Settings

2. Different Costing methods in Sage 300 ERP

3. Create Jobs related Sales Orders in Sage 300 ERP

4. Creating Jobs related Purchase Orders in Sage 300 ERP

5. Check out your Employee timesheet and Expenses with Sage 300 PJC

Sage 300 ERP – Tips, Tricks and Components

Explore the world of Sage 300 with our insightful blogs, expert tips, and the latest updates. We’ll empower you to leverage Sage 300 to its fullest potential. As your one-stop partner, Greytrix delivers exceptional solutions and integrations for Sage 300. Our blogs extend our support to businesses, covering the latest insights and trends. Dive in and transform your Sage 300 experience with us!