I was creating a transaction in X3 and was stuck as the Tax was not getting calculated. I was just wondering the reason for the tax not getting calculated.

I can say that “I discovered’ that In order to calculate the tax you need to add the company code to the specific tax rate codes.

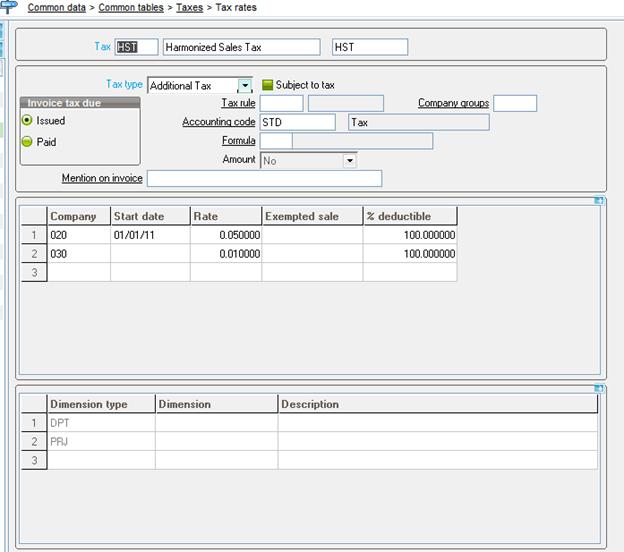

Below are the steps for adding the company code against the tax rate:

1. Navigate through Common Data -> Common Tables-> Tax rate

2. Select the tax rate and the select the company in the Grid and save the tax code.

Now if you use this tax rate for creating X3 Transactions then the tax rate will automatically be calculated as per the rate setup for the company.

Sage X3 – Tips, Tricks and Components

Discover the unmatched potential of Sage X3 with our exclusive blogs. Greytrix is a seasoned Sage expert offering a comprehensive range of Sage X3 services to empower businesses with higher productivity and growth. Here, we share our knowledge and the latest technology trends on Sage X3 through insightful blogs, aiming to enhance your understanding of Sage X3 as an ERP software. Stay updated with our regular posts to leverage the ERP to its full potential.