Zambia E-invoicing Solution: Smart Invoice System by ZRA

A Robust and Trusted Solution for E-Invoicing in Zambia

Registration and Validation

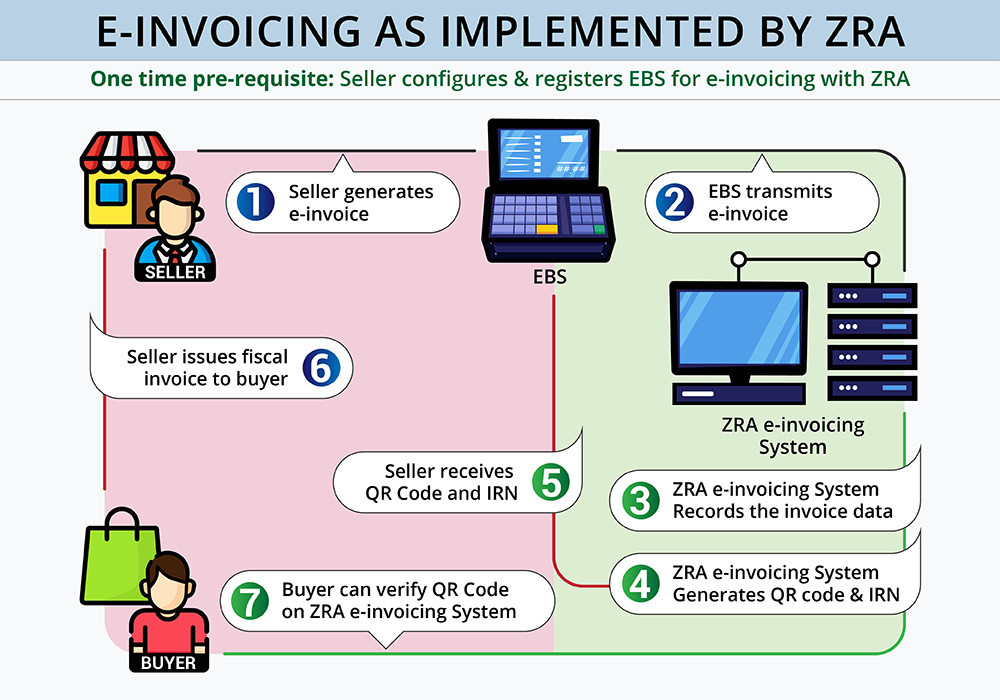

Taxpayers must register and validate their use of the Smart Invoice system with the ZRA.

Downloading the VSCD Module

Download the Virtual Sales Data Controller (VSCD) module to enable data transmission between business ERP systems and the Smart Invoice server.

Electronic Document Transmission

Send all electronic documents to the VSCD for real-time transmission to the ZRA, where they will be validated with a unique identifier code (Mark ID) and a QR code.

Benefits of E-invoicing with Sage ERP Software (Sage X3 | Sage 300)

Ease of Tax filing

Data Security

Bi-Directional Data Integration

Automated Notification Alert

Avoid Tax Evasion

Enhanced QR code capabilities

Improvement in Account Reconciliation

Streamlined Audit Trail

Smart Invoice Solutions

Smart Invoice Desktop and Tablet Application

This application applies to all taxpayers except those using accounting packages and is supported on Windows 10 or higher.Smart Invoice Mobile Application

It is created for Turnover Tax taxpayers and is compatible with Android 8 or later.Online Smart Invoice

Accessed via web browsers, perfect for service industry taxpayers issuing fewer invoices.Certified Invoicing Systems

Integrated with Smart Invoice post-certification, which is ideal for taxpayers using Sage ERP software.What Makes Greytrix Africa's Einvoicing System Better

Expert Integration

Our specialization lies in seamlessly integrating with ERP systems for real-time data transfer to ZRA's Smart Invoice electronic billing system, reducing errors and enhancing efficiency.

Customization

Highly adaptable to meet business and Zambia revenue authority requirements, managing diverse invoicing formats, tax rules, and reporting standards.

Comprehensive Support

Our support includes implementation, training, and maintenance, ensuring smooth compliance with ZRA's Smart Invoice electronic billing system.

Regulatory Compliance

We strictly adhere to ZRA regulations, ensuring continual alignment with legal and technical standards.

FAQ’s

Businesses can create Smart Invoices through:

- The Smart Invoice web portal

- A mobile or desktop app provided by ZRA

- Integration with ERP systems (like Sage X3 or Sage 300) using the Virtual Sales Data Controller (VSCD) for smooth data exchange with ZRA.

Our Partnerships