We are all familiar with TDS procedure but when we deal with TDS e-return we should know the different types of forms and their uses.

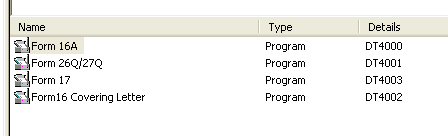

In TDS for Sage 300 ERP, we are providing the below mentioned forms:

1. Form 26Q

2. Form 27Q

3. Form 16A

4. Form 17

5. Form 16 Covering letter

In our todays blog we will discuss about Form 26Q and Form 27Q.

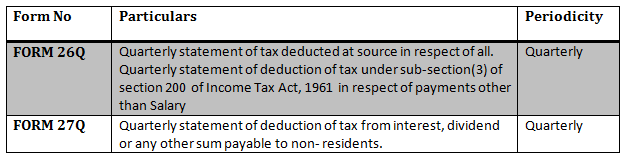

Following are the forms to be used for filing annual/quarterly TDS/TCS returns.

Quarterly Return

Form 26Q:

Form 26Q is required to be submitted for TDS details on all payments other than salary on a quarterly basis by the deductor.

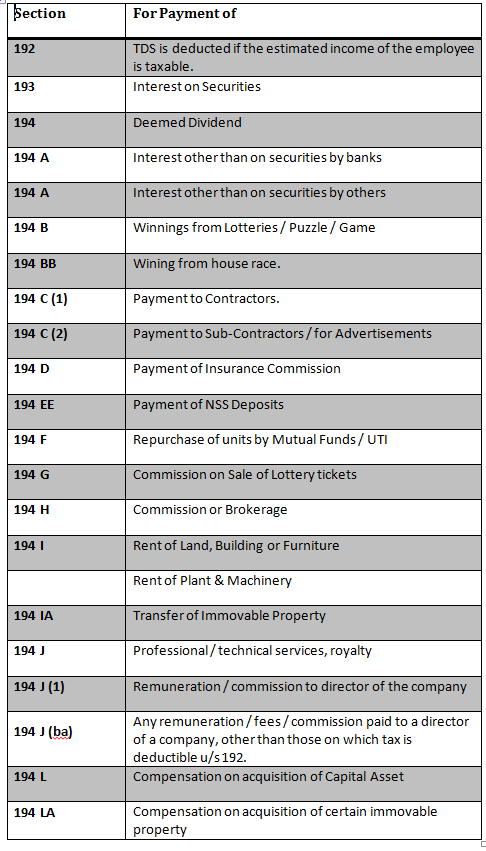

Form 26Q is applicable for TDS deducted under section 200(3) of the Income Tax Act for TDS under sections 193, 194, 194A, 194B, 194BB, 194C, 194D, 194EE, 194F, 194G, 194H, 194I and 194J.

Form 27Q:

Form 27Q is a Quarterly return for deduction of tax in respect of payments made to non-residents other than salary.

Quarterly statement of deduction of tax under sub-section(3) of section 200 of Income Tax Act, 1961 in respect of payments other than Salary made to non-residents

Just to summarize the Form26Q and Form27Q in the below table:

Followings are the updated section in our sage Tax deducted at source that apply in Form 26 and form 27 according to the Indian taxes.

In our next blog we will discuss about the form 16 and form 17.

Also read:

1. Configuring Greytrix TDS in Sage 300 ERP – I

2. Configuring Greytrix TDS in Sage 300 ERP – II

3. Configuring Greytrix TDS in Sage 300 ERP – III