Sage 300 ERP provides various options for default setting which makes the data entry process easier for the admin.

In this blog we will discuss about the default settings available in Account receivable for Invoice entry.

Once you set these options, they will appear by default while generating AR Invoice entry.

New Stuff:Quantity Commit Routine

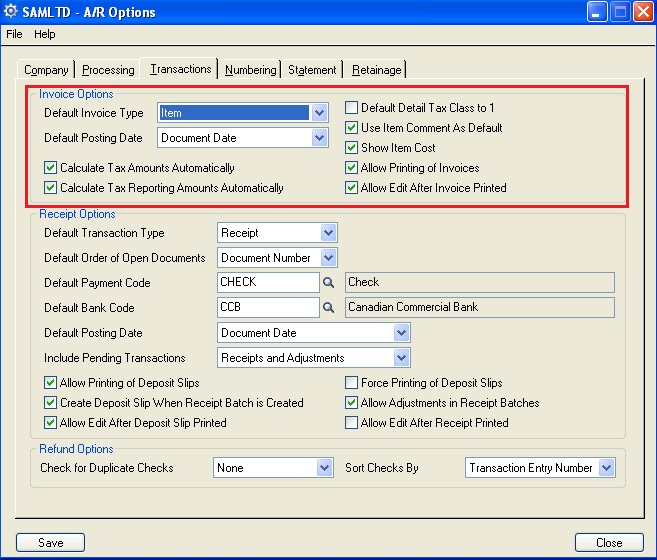

Navigate to Account Receivable –>A/R Setup Options –>Transaction Tab –> Invoice Options

• Default Invoice type:

There are 2 options for default invoice type: Summary or Item.

You can set any one of them as default which you commonly use, so that it will appear as default in AR Invoice Entry.

• Default Posting Date:

The posting date is the date on which a document is posted to General Ledger, and it may be different from the document date. This distinction is particularly useful if you post a document to a year or period that is different from the document date.

There are 3 options available for default posting date:

Document date

Batch Date

Session Date

You can set any of these date as default posting date and Sage 300 ERP (formerly known as ACCPAC) will determine the date that appears as the default posting date on the A/R Invoice Entry screen.

However you can also change or edit the posting date at the time of creating AR Invoice.

• Calculate Tax Amount automatically (Check box):

Checking this option will result in automatic calculation of taxes as for invoices.You can also change the tax calculation method for individual invoices in Invoice Entry.

• Calculate Tax Reporting Amount automatically (Check box):

This will be useful when you have a multi currency database. If your taxes are in a currency that is different from functional currency, invoices must show the tax amount in the tax reporting currency, along with the exchange rate used for the conversion.

Select this option if you want to use automatic tax calculation as the default method for calculating tax reporting amounts on invoices.

• Default Detail Tax Class to 1(Check box):

For Summary Invoice:

– Select this option if you want to use 1 as the default detail tax class for summary Invoice.

– If this option is unchecked, Accounts Receivable uses the customer tax class (Invoice Entry Taxes tab) as the default.

For Item Invoice:

This selection doesn’t have an impact on item invoices.For item invoices, Accounts Receivable uses the tax class set for the item.

• Use Item Comment as default (Check box):

For Item Invoice, you can check this option to display any comments you have entered in AR Item master records automatically when you are entering item details on an invoice entry.

If this option is unchecked, no default comments will get displayed during transaction entry, but you can type a comment of up to 250 characters for every item detail line.

• Show Item Cost (Check box):

If you use a price list for invoice entry, you can use this option to display the extended item cost when you are adding item details in the Invoice Entry screen.

Sage 300 ERP will not allow to change costs in the IC and you cannot print the costs on invoices.

• Allow printing of Invoices (Check box):

On checking this option, you can print invoice, Credit/Debit note in the Invoice Entry screen, or from Invoice Printing screen. This option does not force you to print the documents.

If you want to print the documents after posting the batches, then use Invoice Printing screen.

If you do not select the option, you cannot print invoices from Accounts Receivable.

• Allow edit after invoices printed (Check box):

When you select this option, you will be allowed to do changes in invoice entry after you have printed invoices, credit notes, and debit notes for them. You can also delete them.

Your choice for this option does not apply to batch header information. You can change the batch date or description at any time until you post the batch.

Note: However you can change your choices for these options at any point of time.

Also Read:

1. Default settings for Receipts in Account Receivable in Sage 300 ERP

2. How Deposit date in AR receipt entry plays important role in Bank Reconciliation

3. Default Settings for Accounts Payable Payments in Sage 300 ERP

4. AR Invoice Report

5. Optional to maintain Statistics for Customer, National Account and Group in Sage 300 ERP

Sage 300 ERP – Tips, Tricks and Components

Explore the world of Sage 300 with our insightful blogs, expert tips, and the latest updates. We’ll empower you to leverage Sage 300 to its fullest potential. As your one-stop partner, Greytrix delivers exceptional solutions and integrations for Sage 300. Our blogs extend our support to businesses, covering the latest insights and trends. Dive in and transform your Sage 300 experience with us!