Recently, we were asked about the Tax determination logic used in Sage X3. The user was actually trying to figure out why his Sales Invoice had only one tax applied even though he had selected three Tax levels in the Invoice line. Following is a brief explanation of how Tax is determined for an invoice in Sage X3.

A standard Sage X3 Sales Invoice line has three tax levels. Before we dive in further let us first get ourselves acquainted with following terms:

- Tax Rule [termed as BP Tax Rule]: Tax rule represents the territorial calculation rules that need to be applied to determine the tax amount. The Tax Rule is set up at BP level.

- Tax Level [termed as Product Tax Level]: Tax level only displays the list of the possible rates that can be applied within a single rule.

In Sage X3, Tax can be determined by the combination of the tax rule associated with a BP and the tax level associated with a product.

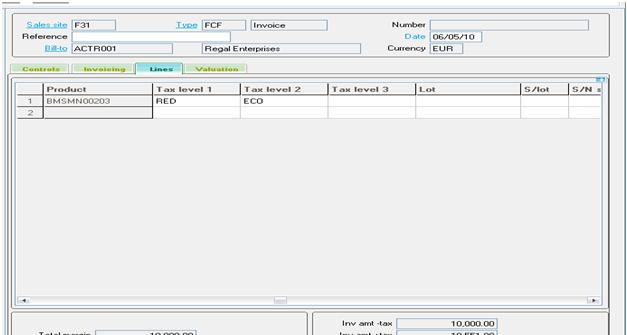

Now let’s proceed with one of the Transaction in Sage X3. A standard Sales invoice Transaction allows you enter three tax levels on invoice line and a single tax rule at the Header Level. So in this way we have an option of applying three taxes of different types to a single invoice line.

But Sage X3 follows some specific rules to assign these taxes against the document as mentioned below:

-

1st Tax Code: If more than one Tax level and Tax rule point to the same tax code then the first Tax code satisfying the condition will be applied.

-

2nd Tax Code/3rd Tax Code: The 2nd /3rd Tax code is only assigned if the Tax Level selected in the Document Detail line is having Tax Type as “Additional Tax /Special Tax”

Example:

If we select the BP tax Rule = “FRA” for a particular Sales Invoice. There will be the list of different product Tax Levels assigned to the BP Tax Rule = “FRA” and every combination of the BP Tax Rule with a product Tax Level creates a tax Determination.

Every Tax Determination has a Tax Code associated with it which consist the Tax Rates slabs defined. While Selecting the Tax Levels in a particular Sales Invoice Line, you should be following these rules:

- The 1st Tax Level should always have Tax Type as the VAT.

- The 2nd Tax Level should have Tax Type either “Additional Tax /Special Tax”.

If we select Tax Levels with Tax Types VAT as well as Additional Tax /Special Tax, on a single line it is only then we will be able to see 2 tax codes against the Single Invoice Line in a document.

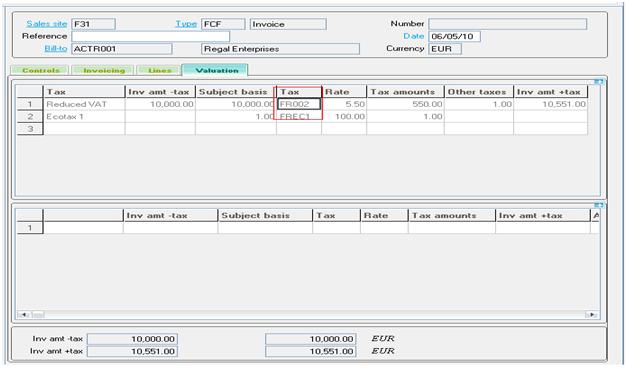

See the below image the Tax Levels selected are

RED: Tax Type= VAT: The combination of BP Tax Rule = FRA and Tax Level1 = RED result into Tax Code = FR002

ECO: Tax Type = Additional Tax: combination of BP Tax Rule = FRA and Tax Level 2= ECO result into Tax Code = FRREC1

The Rate is determined from the Tax Rates screen based on the Tax Code determined from the Tax Determination.

Sage ERP X3 gets interesting as we dig in more deeper.

Sage ERP X3 gets interesting as we dig in more deeper.

About Us

Greytrix – a globally recognized Premier Sage Gold Development Partner is a one-stop solution provider for Sage ERP and Sage CRM needs. Being recognized and rewarded for multi-man years of experience, we bring complete end-to-end assistance for your technical consultations, product customizations, data migration, system integrations, third-party add-on development and implementation expertise.

Greytrix caters to a wide range of Sage Enterprise Management (Sage X3) offerings – a Sage Business Cloud Solution. Our unique GUMU™ integrations include Sage Enterprise Management (Sage X3) for Sage CRM, Salesforce.com and Magento eCommerce along with Implementation and Technical Support worldwide for Sage Enterprise Management (Sage X3). Currently we are Sage Enterprise Management Implementation Partner in East Africa, Middles East, Australia, Asia. We also offer best-in-class Sage X3 customization and development services, integrated applications such as POS | WMS | Payment Gateway | Shipping System | Business Intelligence | eCommerce and have developed add-ons such as Catch – Weight and Letter of Credit for Sage Enterprise Management to Sage business partners, end users and Sage PSG worldwide.

Greytrix is a recognized Sage Rockstar ISV Partner for GUMU™ Sage Enterprise Management – Sage CRM integration also listed on Sage Marketplace; GUMU™ integration for Sage Enterprise Management – Salesforce is a 5-star app listed on Salesforce AppExchange.

For more information on Sage X3 Integration and Services, please contact us at x3@greytrix.com. We will be glad to assist you.