As we know, Sage X3 provides masters for each object used in it like Business Partner, Product, Company, Site etc. We can setup various things for these objects such as id, name, and address etc. on their respective Master screens. Similarly on BP’s master, we can set up default payment term and tax rule against respective company and that BP.

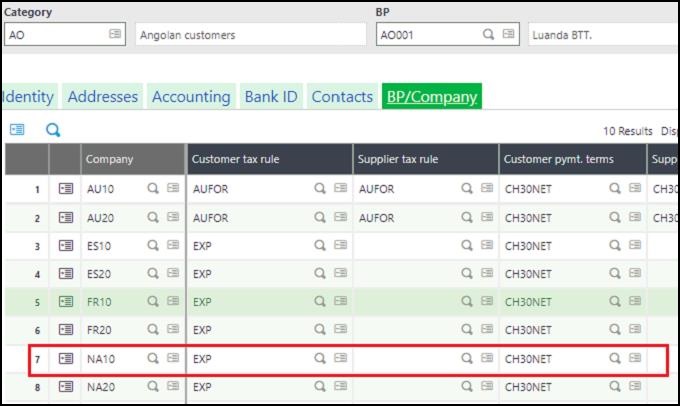

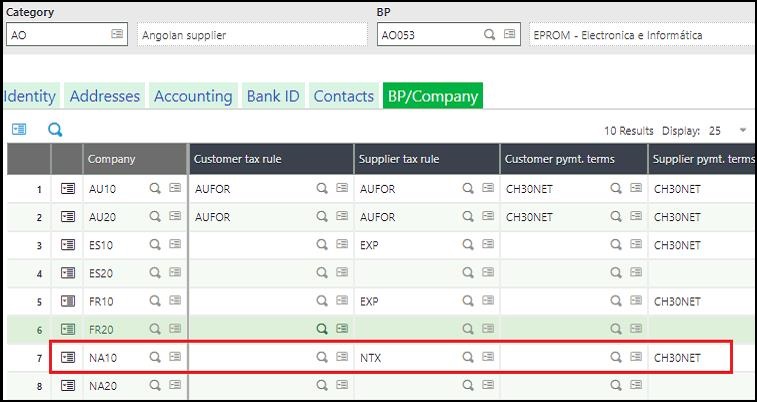

This Business partner can be converted to Customer, Supplier and Sales rep, Carrier or Prospect. In case of customer and supplier, we can define default payment term as well as tax rule for the same. Sage X3 provides a special tab “BP/Company” wherein we can define these default values.

Follow below steps to achieve this:

- Navigate to Common data > BP’s > Bps

- Select BP for which you want set up default tax rule and payment term.

3. Here, you can define default values against respective BP and company. Also, if BP is a customer then Customer tax rule and customer payment term will be fetched while creating sales transactions against particular BP and company. Similarly, if BP is a supplier then Supplier tax rule and Supplier payment term will be fetched when purchase transactions are created against particular BP and company.

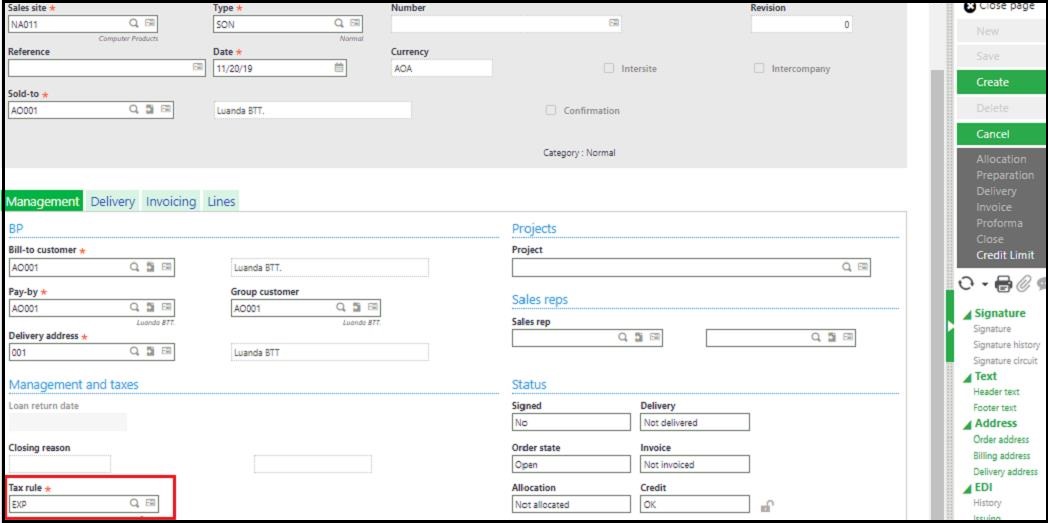

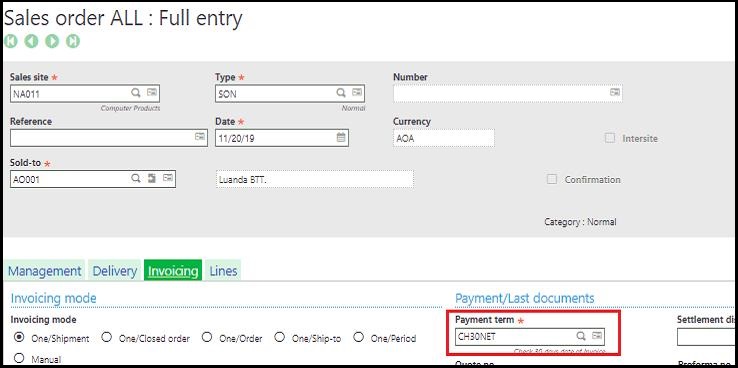

Consider following example for better understanding.

- For Customer “AO001”:

If we create sales order for site “NA001” of company “NA10” against this customer, then you can see in below screenshot, tax rule will be set as “EXP” and payment term will be set as “CH30NET” which is already defined in BP master as above.

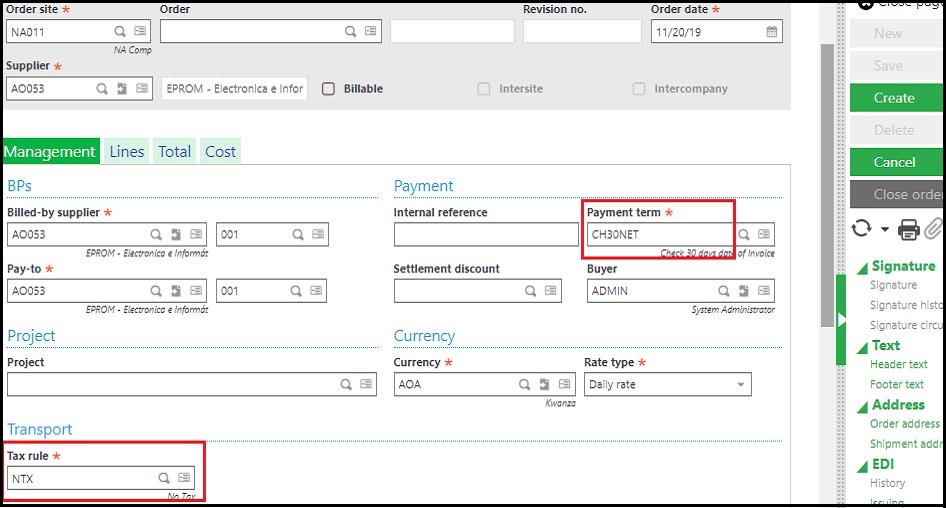

- Similarly when you create purchase order for site “NA001” against supplier “AO053”, as per above setup, tax rule and payment term will be set as “NTX” and “CH30NET”. Refer below screenshots:

In case, no default value is set for any company against particular BP then whatever tax rule and payment term is defined on Customer/Supplier masters will be fetched during Sales order/Purchase order creation respectively. Thus, “BP/Company” tab will allow us to easily set tax rules and payment terms for different companies and access them during transactions .

About Us

Greytrix – a globally recognized Premier Sage Gold Development Partner is a one-stop solution provider for Sage ERP and Sage CRM needs. Being recognized and rewarded for multi-man years of experience, we bring complete end-to-end assistance for your technical consultations, product customizations, data migration, system integrations, third-party add-on development and implementation expertise.

Greytrix caters to a wide range of Sage X3 (Sage Enterprise Management) offerings – a Sage Business Cloud Solution. Our unique GUMU™ integrations include Sage X3 for Sage CRM, Salesforce.com and Magento eCommerce along with Implementation and Technical Support worldwide for Sage X3 (Sage Enterprise Management). Currently we are Sage X3 Implementation Partner in East Africa, Middles East, Australia, Asia. We also offer best-in-class Sage X3 customization and development services, integrated applications such as POS | WMS | Payment Gateway | Shipping System | Business Intelligence | eCommerce and have developed add-ons such as Catch – Weight and Letter of Credit for Sage X3 to Sage business partners, end users and Sage PSG worldwide.

Greytrix is a recognized Sage Rockstar ISV Partner for GUMU™ Sage X3 – Sage CRM integration also listed on Sage Marketplace; GUMU™ integration for Sage X3 – Salesforce is a 5-star app listed on Salesforce AppExchange.

For more information on Sage X3 Integration and Services, please contact us at x3@greytrix.com. We will be glad to assist you.