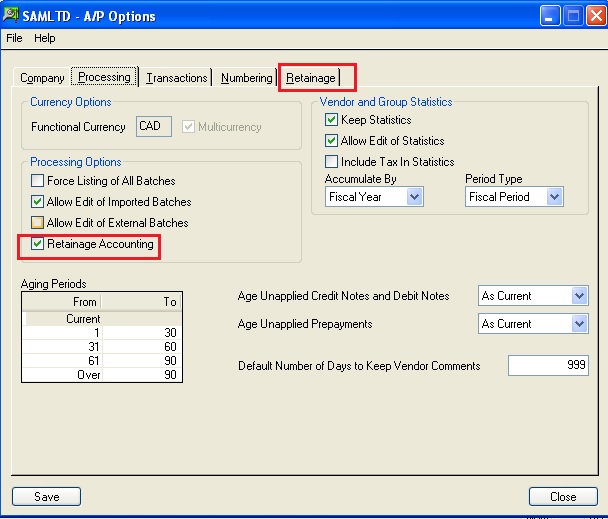

In this blog post, we will discuss about another feature of Sage 300 ERP ‘Retainage Accounting”. In A/P Option, there is a check box ‘Retainage Accounting‘under the ‘Processing ‘tab [Refer screenshot below].

To achieve this, navigate to Accounts Payable –> A/P Setup –> Options -> Processing Tab -> Processing Options

New Stuff: Migrate Open Sales Order From Sage Business Vision to Sage 300 ERP

With this option checked, the user will be allowed to use Retainage Accounting.

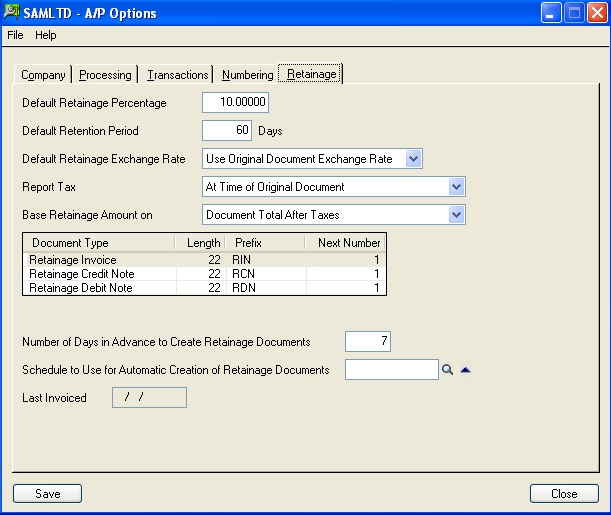

When you select the Retainage Accounting option, the Retainage tab appears on the options form, letting you specify retainage processing options.

In Retainage Tab you can define various fields like:

• Base Retainage Amount On:

Here you can select whether retainage will be calculated on the document total before tax or after tax.

• Default Retainage Exchange Rate:

If you use multicurrency, specify whether to use the current exchange rate or the exchange rate used for the original document as the default for retainage documents.

• Default Retainage Percentage:

Here you can enter the percentage of the document total to withhold on invoices, credit notes, and debit notes. This percentage will appear as the default when you add new vendors, but you can change the retainage (or holdback) percentage for particular vendors in the vendor record.

• Default Retention Period:

Enter the number of days from the original document date that you can withhold the retained amount from vendors. The program determines the default retainage due date by adding the retention period to the original document date.

The default retention period is used for new vendor records, but you can specify different ones for individual vendors. You can also change the retention period on invoices.

• Document Numbering :

Accounts Payable uses a separate numbering system to identify retainage documents that you generate using the Create Retainage Batch form.

The retainage document numbering grid lets you specify the next number, length, and prefix to assign to retainage invoices, credit notes, and debit notes, or you can accept the default that appears on the grid.

• Last Invoiced (display only):

It displays the date that you ran Create Retainage Batch from the Reminder List on.

• Number Of Days In Advance To Create Retainage Documents:

Enter the number of days before the retainage due date that you can generate retainage documents using the Create Retainage Batch form.

For example, if you enter 5, you can generate the retainage invoice five days before the retainage is due.

• Report Tax:

Generally, when you post invoices, Accounts Payable posts tax amounts to a tax account (either tax recoverable or tax expense) or to another general ledger account, and it updates the tax tracking reports.

For retainage, when the tax is reported can differ. Some tax authorities expect you to report tax when you post a retainage document; others let you report tax when you post an original document to which retainage applies.

The Report Tax option lets you specify when to report tax on retainage. You can make the following selections for this option:

1. At Time Of Original Document

2. As Per Tax Authority

• Schedule To Use For Automatic Creation Of Retainage Documents (optional):

Enter or use the Finder to select the code for the schedule you want to use to process retainage from the Reminder List.

If the schedule does not yet exist in Common Services, you can click the zoom button ( ) beside the field, then create the schedule using the Schedules form that opens. You can also click the zoom button after entering a schedule code to view information about the schedule.

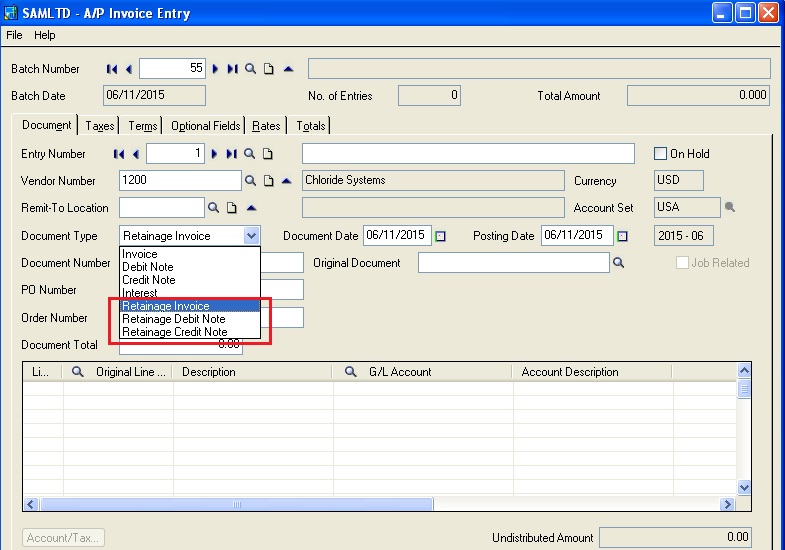

When Retainage Accounting option is checked, you can create Retainage Invoice, Retainage Debit Note and Retainage Credit Note in AP Invoice Batch. (Refer below screen shot)

You can turn off the Retainage Accounting option, later, only if there are no unposted retainage batches and no outstanding retainage amounts.

Also Read:

1. Allow Non Inventory Item Option in PO

2. Allow Fractional Quantities in Purchase Order

3. Allow edit of System generated batches

4. Allow Adjustments in Payment batches

5. Allow editing of external batches

Sage 300 ERP – Tips, Tricks and Components

Explore the world of Sage 300 with our insightful blogs, expert tips, and the latest updates. We’ll empower you to leverage Sage 300 to its fullest potential. As your one-stop partner, Greytrix delivers exceptional solutions and integrations for Sage 300. Our blogs extend our support to businesses, covering the latest insights and trends. Dive in and transform your Sage 300 experience with us!