Reversing a journal entry is a fundamental accounting process involving the undoing of a previously recorded transaction. It is commonly used to correct errors, adjust entries, or ensure accurate financial representation in an organization’s records. Reversals, often applied to entries from the previous accounting period, streamline processes, simplify reconciliation, and maintain precise financial reporting. This practice, executed at the start of a new accounting period, enhances accuracy and transparency and contributes to a company’s financial health.

Key Features:

Reversing a Journal Entry associated with a Credit Memo is a crucial accounting process that requires careful consideration to ensure accurate financial reporting. While the concept of removing a Sales Credit Memo (SCM) from Open Items and Aging reports may seem straightforward, several factors need to be taken into account to execute the reversal effectively. The following considerations play a pivotal role in this process:

1. External Document Release:

* Verify whether the Credit Memo associated with the Journal Entry has been released externally. If the document has been communicated beyond your company, it introduces external dependencies that may impact the reversal process.

* If the document has been released externally, it is advisable to evaluate the appropriateness of using a countering Accounts Payable (AP) document, such as a debit memo, to offset the effects of the Credit Memo. This ensures accurate and compliant accounting treatment.

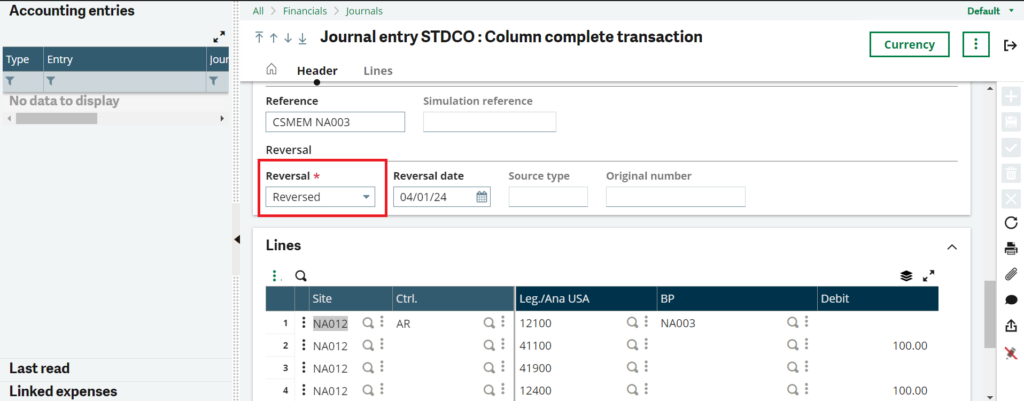

2. Journal Entry Status:

* Check the status of the Journal Entry. If it is not in ‘Temporary’ status, indicating that it has been finalized, adjustments are necessary before proceeding with the reversal.

* Set the JE Reversal flag to ‘Yes’ and initiate the reversal process. This can typically be done through the financial system’s interface, often found in the Financials module, under Current Processing, and specifically in the Reversals section.

3. Accounting Period Status:

* Confirm whether the accounting period relevant to the Journal Entry is open. Reversing entries cannot be made in closed periods.

* If the period is closed, set the JE Reversal flag to ‘Yes’ and execute the reversal process through the designated financial processing module.

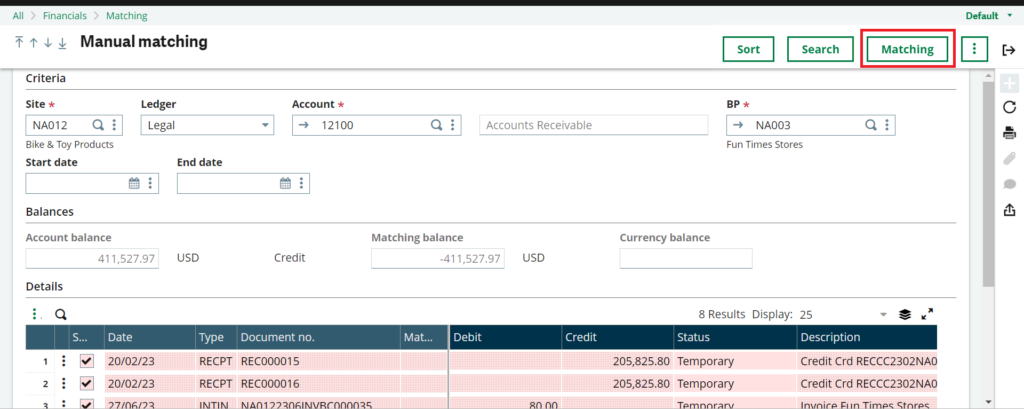

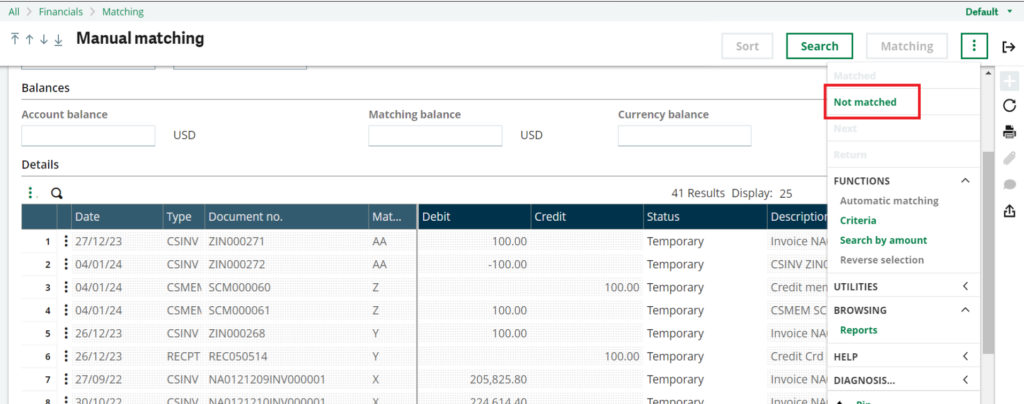

4. Document Matching:

* Check if the Credit Memo is matched with other documents, such as invoices or purchase orders. Matching can create dependencies that need to be resolved before the reversal.

* Unmatched the Credit Memo if necessary to disentangle it from other documents and facilitate a clean reversal process.

5. Reporting Integration:

* Ensure that relevant financial reports are aware of the Journal Entry reversal flag. This is crucial to maintaining transparency in financial reporting.

* Verify that Open Items and Aging reports appropriately reflect the reversal status of SCMs, providing accurate insights into the current financial state of the organization.

By addressing these considerations, organizations can confidently execute the reversal of a Journal Entry associated with a Credit Memo, thereby ensuring the accuracy and reliability of their financial records and reports.

In conclusion, reversing a Journal Entry linked to a Credit Memo is a critical aspect of accounting, requiring careful consideration for precise financial reporting. Key steps, including addressing external document release, Journal Entry status, accounting period status, document matching, and reporting integration, are essential for a successful reversal. By these considerations, organizations can confidently manage Journal Entry reversals, ensuring accuracy and integrity in their financial records.

About Us

Greytrix – a globally recognized Premier Sage Gold Development Partner is a one-stop solution provider for Sage ERP and Sage CRM needs. Being recognized and rewarded for multi-man years of experience, we bring complete end-to-end assistance for your technical consultations, product customizations, data migration, system integrations, third-party add-on development and implementation expertise.

Greytrix caters to a wide range of Sage X3 (Sage Enterprise Management) offerings – a Sage Business Cloud Solution. Our unique GUMU™ integrations include Sage X3 for Sage CRM, Salesforce.com and Magento eCommerce along with Implementation and Technical Support worldwide for Sage X3 (Sage Enterprise Management). Currently we are Sage X3 Implementation Partner in East Africa, Middles East, Australia, Asia. We also offer best-in-class Sage X3 customization and development services, integrated applications such as POS | WMS | Payment Gateway | Shipping System | Business Intelligence | eCommerce and have developed add-ons such as Catch – Weight and Letter of Credit for Sage X3 to Sage business partners, end users and Sage PSG worldwide.

Greytrix is a recognized Sage Rockstar ISV Partner for GUMU™ Sage X3 – Sage CRM integration also listed on Sage Marketplace; GUMU™ integration for Sage X3 – Salesforce is a 5-star app listed on Salesforce AppExchange.

For more information on Sage X3 Integration and Services, please contact us at x3@greytrix.com. We will be glad to assist you.